Budget 2024

Hon Nicola Willis, the Minister of Finance, delivered the 2024 Budget on Thursday, 30 May 2024.

The Minister announced that Budget 2024 delivers on key commitments including the following:

a fiscally responsible Budget that delivers on the Government’s commitments

the tax relief that gives average-income households up to $102 per fortnight plus Family Boost childcare payments up to $150 per fortnight

targeted investments in public services, including healthcare, education and law and order

savings across government to responsibly fund tax relief and boost frontline services

infrastructure investments for growth, and

fiscal discipline to get back to surplus and lower debts.

The Budget 2024 includes the following proposed measures:

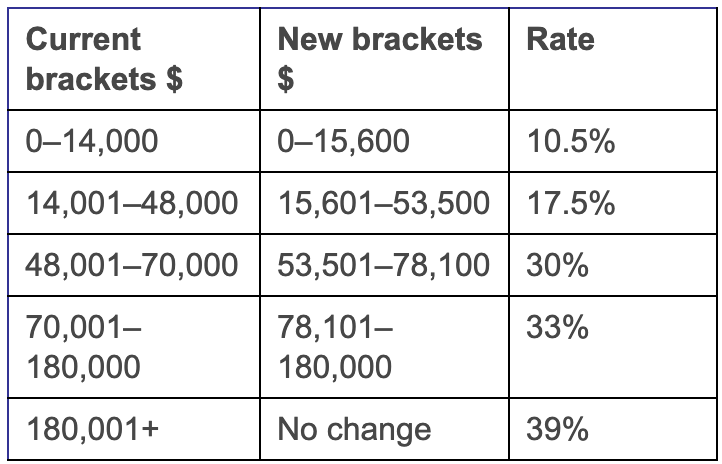

Changes to personal income tax thresholds

From 31 July 2024, income tax thresholds will increase:

Extending the Independent earner tax credit (IETC)

From 31 July 2024, the IETC will be available to eligible individuals earning between $24,000 and $70,000 per annum.

The IETC is a tax credit of up to $20 per fortnight that is currently available to those earning between $24,000 and $48,000 per annum. Those eligible can receive the IETC during the year by using an appropriate tax code, or get it all at the end of the year.

To recognise the impact of wage growth, the upper limit of eligibility for the IETC is being extended from $48,000 to $70,000 per annum. Those earning $24,000 to $66,000 per annum receive the full credit, with entitlements gradually reducing as income increases, up to the limit of $70,000.

Increasing the In-Work tax credit (IWTC)

From 31 July 2024, the IWTC will increase by up to $50 per fortnight.

The IWTC is a tax credit for families with dependent children who are normally in paid work. The increase of $50 per fortnight (which gradually reduces as family income rises) will further support low-to-middle income families.

The minimum family tax credit (MFTC) tops up the after-tax income of eligible low-income working families to a guaranteed minimum amount. This guaranteed minimum will be increased slightly to allow MFTC recipients to benefit from the personal income tax changes (on top of the full $50 per fortnight IWTC increase).

Introducing FamilyBoost

FamilyBoost is a new childcare payment that will be available to low-to-middle-income families with children aged 5 and under, to help with the costs of early childhood education.

From 1 July 2024, parents and caregivers will be eligible for a partial reimbursement of their early childhood education fees, up to a maximum fortnightly payment of $150. Reimbursements will be made quarterly, as a lump sum. The first payments will therefore be made from October 2024.

Parents and caregivers can get back up to 25% of their early childhood education fees, after the 20 hours early childhood education and MSD childcare subsidy have been taken into account, up to the $150 maximum.

This maximum payment slowly reduces for family incomes over $140,000 per annum. Families with incomes over $180,000 per annum are not eligible for Family Boost.

Overseas student loan interest rate change

Budget 2024 increases the interest rate charged to student loan borrowers who are based overseas by 1% for 5 years taking effect from 1 April 2025. The new rate is forecast to be 4.8%. The Government intends to introduce legislation to make this change.

The 1% increase will also increase the late payment interest for overseas and New Zealand based borrowers.

Source: Budget 2024, Budget Government NZ website, 30 May 2024, accessed 30 May 2024.