Bright-line test - Proposed changes

Proposed extension to 10 years, excluding new builds, and changes to the treatment of times when the property is not the owner's main home.

This fact sheet summarises changes the Government intends to make to the taxation of residential property.

Once legislation is enacted, more details will be available at ird.govt.nz/property.

This fact sheet is to inform people making decisions about buying or selling property of the proposed changes and how they might affect them.

Extension of the bright-line test to 10 years –

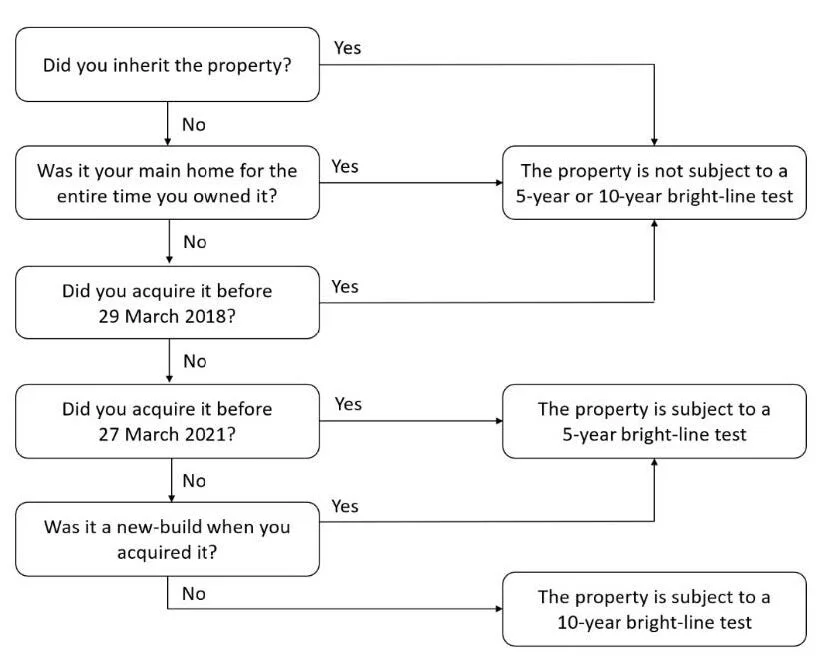

The bright-line test means if you sell a residential property within a set period after acquiring it you will be required to pay income tax on any profit made through the property increasing in value. The current bright-line period is 5 years. The Government has announced it intends to extend the bright-line period to 10 years for residential property except newly built houses (new builds). Inherited properties and those which have been the owner's main home for the entire time they owned it will continue to be exempt from all bright-line tests.

To determine what length of bright-line test a property is subject to the following flow-chart can be used.

This section explains when property is acquired for these purposes.

When a property is acquired –

For tax purposes, a property is generally acquired on the date a binding sale and purchase agreement is entered into(even if some standard conditions like getting finance or a building report still need to be met). Full information on when a property is acquired is found in QB 17/02 on taxtechnical.ird.govt.nz

For the purposes of the changes outlined in this factsheet, a property acquired on or after 27 March 2021 will be treated as having been acquired before 27 March 2021, if the purchase was the result of an offer the purchaser made on or before 23 March 2021 that cannot be withdrawn before 27 March 2021.

The date you acquire property determines whether the bright-line period is 5 or 10 years. This will also determine which set of rules relating to the main home exclusion and change of use will apply to your property. In either case, the period is then counted from the date the land is transferred to you (generally the settlement date).

There will be consultation on what will be considered a new build –

The definition of a new build will be worked out in consultation with the tax and property communities over the coming months, but it is intended to include properties that are acquired within a year of receiving their code compliance certificate under the Building Act 2004.

Legislation to define 'new builds' and exclude them from the proposed 10-year test is intended to be introduced into Parliament after consultation. The Government intends for the legislation to be retrospective such that new builds acquired on or after 27 March 2021 would continue to be subject to a 5-year bright-line test.

Changes to the treatment of times when a property is not the owner's main home –

The government is making the rules fairer around the change of use of a main home with respect to the operation of the bright-line test.

Any residential property that has been used as the owner's main home for the entire time they owned it will continue to be exempt from any bright-line test.

For residential properties acquired on or after 27 March 2021, including new builds, the Government intends to introduce a 'change-of-use' rule. This will affect the way tax is calculated if the property was not used as the owner's main home for more than 12 months at a time within the applicable bright-line period.

If a property switches to or from being the owner's main home and the period when it is not their main home is 12 months or less, they do not need to count that as a change-of-use – those non-main home days are 'treated as' main home days. For example, if an owner takes a few months to move into a property, or owns it for a few months after moving out, this does not trigger the bright-line test.

The owner of a property subject to the change-of-use rule will be required to pay income tax on a proportion of the profit made through the property increasing in value, calculated as follows:

subtract the purchase price from the sale price

subtract the cost of capital improvements the owner has made

subtract the costs to buy and sell the property, and

multiply the result by the proportion of time the property was not being used as the owner's main home.

If a residential property was acquired on or after 29 March 2018 and before 27 March 2021, the existing main home exclusion rules will continue to apply. These can be found at ird.govt.nz/property. In short, the main home exclusion from the existing 5-year test applies on an all or nothing basis, depending on whether the property was used for most of the bright-line period as the main home. Changes-of-use do not need to be accounted for.

What the proposed changes mean for you –

This section describes what the proposed changes mean for you if you acquire a residential property on or after 27 March 2021.

If you sell the property more than 10 years after acquiring it (or 5 years for a new build), you will not pay tax under the bright-line test on any gain in value.

If you sell the property within 10 years of acquiring it (or 5 years for a new build), and it was your main home for the entire time you owned it, you will not pay tax under the bright-line test on any gain in value. However, if the property was your main home, but was used for other purposes for more than 12 months during the time you owned it, you must pay income tax on the profit from the gain in value of the property as detailed in the previous section.

If you sell the property within 10 years of acquiring it (or 5 years for a new build), and it was never your main home for the entire time you owned it, you will pay tax under the bright-line test on any gain in value.

Any profit from a gain in property value that is considered taxable income (including under any of the bright-line tests) will also affect any other obligations or entitlements you have based on taxable income, such as student loan repayments, child support payments, and Working for Families. This effect would be in the year you need to include the income on your tax return.

Short-stay accommodation –

The legislation will also ensure that residential properties used to provide short-stay accommodation, where the owner does not live in the property, are subject to the bright-line test, and cannot be excluded as business premises.

Other land sale rules still apply –

There are other rules in the Income Tax Act 2007 that can tax gains on the sale of land (including residential land).

For example, there are tax rules that apply to speculators, land developers and dealers. Those rules will continue to apply, regardless of when the property was purchased. The bright-line tests potentially apply only if none of the other land sale rules apply.

Regardless of the bright-line tests, anytime you purchase property with the intention of selling it you must pay tax on the profit unless an exemption applies.

Examples –

The following examples are provided to help clarify the proposed new rules. For the sake of simplicity, we have rounded all dates to years when in reality they would be counted by days. We have also not included any costs related to acquiring or selling the properties, where in reality such costs could be deducted from any profit prior to calculating the proportion that is taxable income. Detailed examples will be available in commentary to the draft legislation.

Example 1: Main home to rental property

Manaia buys a property in 2022 for $800,000. It is not a new build. The property is used as her main home until 2028 when she moves overseas and rents it out.

In 2030 she sells the property for $1.1 million. She did not make any improvements to the property.

Manaia owned the property for 8 years. Because it was not a new build the applicable bright-line period is 10 years.

Because she sold it within 10 years of buying it, the bright-line test applies.

The property was Manaia's main home for the 6 years she lived in it (2022 to 2028) so she will pay tax for the remaining 2 of the 8 years she owned the property. Her additional taxable income in the year she sells the property is $75,000 – being 2/8ths of the $300,000 ($1.1 million - $800,000) profit. Manaia will need to add this to her income in her tax return and pay tax on it accordingly.

Example 2: Rental property to main home

Joseph buys a new build house in 2025 for $1 million and immediately lists it for rent on a short-stay accommodation website. The property is used for short-stay accommodation until 2027 when Joseph moves in and uses it as his main home. He spends $100,000 on double glazing and a new deck.

Joseph sells it 2 years later (in 2029) for $1.2 million.

Joseph owned the property for 4 years. Because it was a new build the applicable bright-line period is 5 years.

Because he sold it within 5 years of buying it, the bright-line test applies.

The property was Joseph's main home for the 2 years he lived in it (2027 to 2029) so he will pay tax for the remaining 2 of the 4 years he owned the property. His additional taxable income in the year he sells the property is $50,000 – being 2/4ths of the $100,000 ($1.2m - $1m - $100,000) profit. Joseph will need to add this to his income in his tax return, and pay tax on it accordingly.

Example 3: Rental Interval

Jermain buys a property in 2023 for $600,000. It is not a new build. The property is used as his main home until 2026 when he rents it out. He spent $40,000 adding a bedroom. Jermain moves back into the property in 2028, before selling it in 2031 for $800,000.

Jermain owned the property for 8 years. Because it was not a new build the applicable bright-line period is 10 years.

Because he sold it within 10 years of buying it, the bright-line test applies.

Jermain used the property as his main home for the 6 years he lived in it (2023 to 2026 and 2028 to 2031), so he will pay tax for the remaining 2 of the 8 years he owned the property. His additional taxable income in the year he sells the property is $40,000 – being 2/8ths of the $160,000 ($800,000 - $600,000 - $40,000) profit. Jermain will need to add this to his income in his tax return and pay tax on it accordingly.

Example 4: Property sold within 12 months of change-of-use

Lilly acquires a property in 2022 which she uses as her main home. In 2025 she buys a new property and moves into it. It takes 9 months to sell the old property.

As Lilly was already living in her new home, there has been a change-of-use for the old property during the 9 months it took to sell – it is no longer her main home.

Because the time between the change-of-use and the date the property was sold is less than 12 months, Lilly does not need to pay tax on any gain in value.

Example 5: New home build

Teuila acquires a property on 3 December 2022, which received its code compliance certificate on 28 August 2022.

She rents the property out continuously until she sells it in 2030.

Teuila owned the property for 8 years. Because it was a new build the applicable bright-line period is 5 years.

Because she sold it after more than 5 years she has no tax to pay under the bright-line test.

Example 6: Property acquired before 27 March 2021

Junior bought a property in 2020 for $500,000, which he used as his main home for 1 year. He then rented out the property for 3 years before he sold it in 2024 for $600,000. He made no capital improvements to it.

Because Junior acquired the property before 27 March 2021 (and after 29 March 2018), the applicable bright-line period is 5 years, and the change-of-use rule does not apply. Because he sold it within 5 years of buying it, the bright-line test applies.

Junior used the property as his main home for 1 out of the 4 years he owned it. Under the bright-line test for properties acquired before 27 March 2021, this does not qualify as his main home, as it was not his main home for most of the time he owned it. Under those same bright-line rules, Junior's additional taxable income in the year he sells the property is the full $100,000 profit (the difference between the purchase and sale price: $600,000 -$500,000). Junior will need to add this to his income in his tax return and pay tax on it accordingly.

Source: IRD